How to Graduate College Debt Free

Steps to Help You Minimize College Debt

As you know, college is a substantial investment. It is an investment of your time, energy, and resources. By all accounts, it is well worth the investment to invest in yourself. The National Postsecondary Student Aid Study estimates the value-added earnings from a college degree is roughly 15 times the magnitude of the present value of debt.

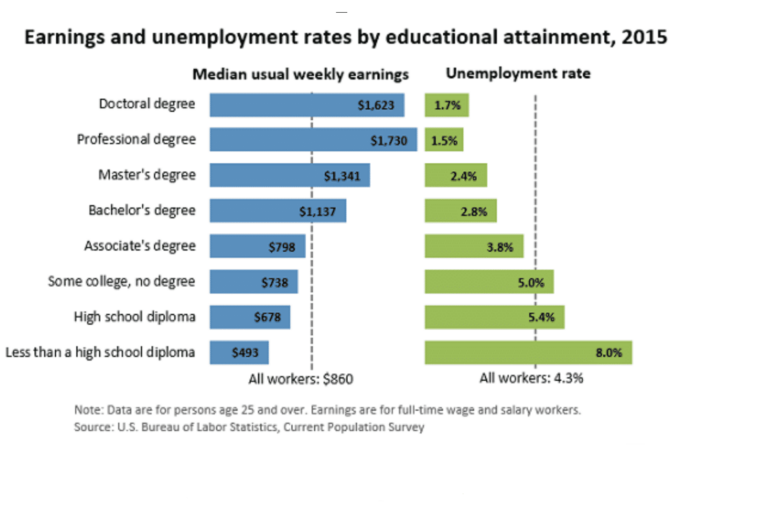

Additionally, an individual earning a bachelor’s degree on average earns more than $1 million dollars more than their counterparts with only a high school diploma. Students earning an associate’s degree earn a staggering $360,000 more on average than those with a high school diploma only according to a recent study by The White House. Put another way, the median full-time, full-year worker with a bachelor’s degree over 25 years of age earned 70% more than a worker with a high school diploma.

The Bureau of Labor Statistics reveals a very high correlation between education and employment stability. As you can see from the attached chart, the more education you have not only results in a substantive increase in income but also a reduction in the unemployment rate.

Further, research performed by Georgetown University reveals that nearly 99% of all new jobs created in the US since 2010 went to individuals with a college degree. Is college a solid investment in your future? As you can see from the data, there is a preponderance of evidence affirming the value of earning a college degree to help secure your future. In this article, we will discuss ways to make your online college experience more cost effective thus making your investment in your education even more attractive.

Finding the Right College for You

The single biggest driver of your online college budget will likely be tuition. Knowing this will be such an impactful decision, make sure to do your research. Instead of relying on a magazine or recommendation for a friend, shop around. In order to find the best program for you, start by developing a list of priorities and matching up your list with a short list of prospective colleges.

Online portals like MatchCollege covers over 7,000 colleges and universities in the US with information about the school, programs, degrees, virtual tours, and contact information to quickly assemble information about a variety of schools. For an in-depth look at finding the right college or university for you, read our ebook on the college admission process.

Leverage College Scholarships

Like grants, scholarships are a great financial tool you may be able to leverage to help pay for your online college program that do not need to be repaid. With over thirty thousand different scholarships available to students, you will need to do your research and apply for the best scholarships available. Some scholarships are state-based, regionally restricted, based on your ethnicity, academically focused, based on your athleticism, and school-based. Do your research and determine which scholarships are best for you after determining the best online college program.

Find State & School-Based Grants

Grants are an immensely beneficial means for students to help reduce the overall cost of a college education. A grant, unlike a loan, does not need to be repaid. A college grant is essentially a type of financial aid that is offered by federal agencies, state agencies, corporations, and/or non-profit organizations.

According to The White House’s recent broad-based study on higher education, Pell Grants are the primary form of financial aid for many college students. Did you know Pell Grants reduce the cost of tuition by $3,700 for over 8 million students per year? Funding for Pell Grants increased $12 billion dollars which equates to a 67% increase from 2008 to 2014 with the maximum award increasing by $1,000. Be sure to ask your counselor or the school’s financial aid department about the all your grant options along with the Pell for Accelerated Completion program and the On-Track Pell Bonus to see if you qualify.

Complete the FAFSA Early

Do you know what FAFSA stands for? A prospective college student should know it stands for the Free Application for Federal Student Aid. The FAFSA form has recently been streamlined and can result in a substantial amount of student financial aid to help you pay for college. If you are unclear how to complete the form or have questions, please make sure to reach out the FAFSA team or your tax professional.

The FAFSA application process is used by millions of students and should be a vital tool to best prepare you for college. While obtaining a low cost federal student loan is not the first option to reduce the cost of college, it can be a viable means to bridge the gap between your resources and those at your dispose.

Leverage the America Opportunity Tax Credit (AOTC)

The AOTC is a tax credit that was created at the federal government level for low-income and middle-income families to help mitigate the cost of higher education. The AOTC provides for a maximum tax credit up to $10,000 over four years’ time for qualifying families and has been expanded five-fold in the past 4 years.

Take CLEP Tests

A CLEP test is also known as a College Level Examination Program which is designed to assess a student’s knowledge in a given subject area. If your life experience or work experience has prepared you with a base level of knowledge in a specific area of study, you can register for a campus-based CLEP exam. The exams are available in a wide range of subjects ranging from business to math to history and English, to name a few. If you pass the exam, you can effectively bypass the respective class(es) saving you the time and the cost associated with taking the course.

Test Out of a Class and Challenge Exams

Like a CLEP exam, some colleges allow students to test out of an entire course based on the successful completion of an exam or assessment. If you are a subject matter expert in a specific area of study, make sure to ask the college or university if you are able to test out of a class or set of classes.

Similarly, a challenge exam may be another route to sufficiently demonstrate to the school an acceptable proficiency in an area of study to help you receive credit for a class that would otherwise be redundant for you. Each school has differing rules, procedures, and fees associated with a challenge exam so ask what options exist for you during the registration process.

National Exams for College Credit

The American Council on Education provides a national platform for students to earn college credits for successfully completing specific classes. Their CREDIT portal was designed to connect workplace learning to colleges and universities in an effort to standardize specific knowledge and work experience with college courses.

Utilize the DANTES Program

For current or former members of the US Military, the Defense Activity for Non-Traditional Education Support (DANTES) may be an option for you. Eligibility requirements can be found here and was created to help students earn college credits by demonstrating competence within a specific subject matter. If your college or university allows DANTES or DSST credits, you can register to take an exam to earn course credits in lieu of taking the course.

Obtain Alumni Referrals

As simple as it sounds, if you refer a friend or co-worker to a college or university who, in turn, is granted admissions and successfully registers with the college, you may be eligible for a reduction in your tuition. While the typical reduction may only be $50-$100, but every little bit helps!

Save on Your College Textbooks

You may be able to save a significant amount of money towards your online college by understanding the cost of textbooks. More specifically, some colleges and universities include the cost of textbooks with the tuition which can be a large savings over 2-4 years’ time. You may also be able to rent or buy ebooks in place of physical textbooks with Chegg, TextBooks, BookByte, Amazon, and VitalSource.

Income Tax Savings

While there are a number of college savings plans available today, the two most popular are the 529 Plan and Coverdale ESA. The 529 Savings Plan allows your contributions to grow tax free so long as the account is used for expenses directly associated with college. Most states in the U.S. offer two types of 529 Savings Plans: prepaid and college savings plan. On the other hand, a Coverdale Education Savings Account is a trust or custodial account that can be used for both pre-college and college expenses.

Making Money While in College

Another popular way to minimize college debt is to earn money while going to school. A growing percentage of college students attend school part-time while working full-time. For those without a full-time job, there are a number of options to choose from to earn money while in school. A few options to consider include:

- Freelancing

- Paid Internships

- Tutor

- Rent or sublet your house/apartment (as applicable)

- Baby-sit or house-sit

- Write for a publication or blog

- Use eBay to sell items you no longer need

- Work-study jobs

The balance will be to have work fit with school in terms of flexibility, your hours, resources, and company culture. Finding the right fit may take some creativity and industriousness, but having the work fit your schedule is of great importance.

Reducing Your Monthly Expenses

The final piece of the puzzle to reduce debt is to minimize your monthly expenses. A few quick ideas can end up saving you thousands of dollars per year.

Food. You can reduce food expenses by limiting the number of times you eat out at restaurants and elect to cook at home. Preparing several meals at once will allow you to buy in bulk and freeze meals to be consumed later. Utilize coupons when you are able as they really can add up quickly. Lastly, if you have a meal plan on campus, utilize all the meals on your plan.

Transportation. Leaving your car at home can translate to big yearly savings. If you are able to avert car payments, automobile insurance, parking fees, gas, and maintenance you will be surprised how much you can save.

Housing. Working diligently to reducing housing expenses can also make a large impact in your monthly expenditures. Electing to live in a modest dorm instead of the brand new dorm can be an option. Perhaps renting a home further from campus on a bus line will make sense to consider. Many college students we work with have multiple roommates to help defer the overall cost of housing. Minimizing utilities is another easy option to consider as you remain vigilant about heating and cooling your home. The final consideration is a growing trend for many college students: living at home while attending school.

By taking full advantage of financial aid, income opportunities, and expenditure reduction, you will be well on your way to graduating college debt free. For additional resources, make sure to visit MatchCollege and subscribe to our blog for the latest in college information.